What is currency in circulation?

It is the total value of currency (coins and paper currency) that has ever been issued by the

Reserve Bank of India minus the amount that has been withdrawn by it.

Currency in circulation comprises of:

- currency notes and coins with the public

- cash in hand with banks.

It is a major liability component of a central bank’s balance sheet.

What is reserve money (M0)?

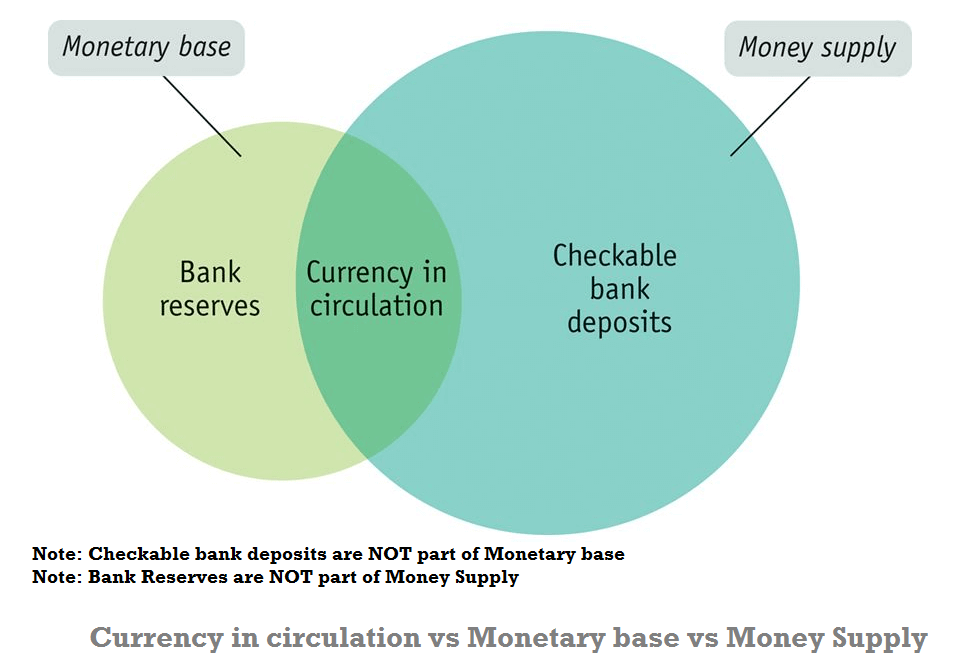

Reserve money is also called central bank money, monetary base, base money, high-powered money, and sometimes narrow money. In the most simple language, Reserve Money is Currency in Circulation plus Deposits of Commercial Banks with RBI.

Reserve money equals :

It is the base level for money supply or the high-powered component of money supply.

What is money supply (M1-M3)?

Money supply is the total stock of money circulating in an economy. In general terms, it is also called broad money. In the most simple language, Reserve Money is Currency in Circulation plus Deposits in Commercial Banks.

Money supply consists of:

- total currency circulating in the public plus

- the non-bank deposits with commercial bank.

Money supply includes deposits generated in the banking system resulting from a multiplier effect of movement of currency in the banking system as well as other forms of liquid assets.

Money Aggregates: Standard Measures of Money Supply

In short, there are two types of money.

- Central bank money (M0)- obligations of a central bank, including currency and central bank depository accounts.

- Commercial bank money (M1-M3) – obligations of commercial banks, including current accounts and savings accounts.

In the money supply statistics, central bank money is M0 while the commercial bank money is divided up into the M1-M3 components.

Generally, the types of commercial bank money that tend to be valued at lower amounts are classified in the narrow category of M1 while the types of commercial bank money that tend to exist in larger amounts are categorized in M2 and M3, with M3 having the largest.

Reserve Money (M0):

- = Currency in circulation + Bankers’ deposits with the RBI + ‘Other’ deposits with the RBI

- = Net RBI credit to the Government + RBI credit to the commercial sector + RBI’s claims on banks + RBI’s net foreign assets + Government’s currency liabilities to the public – RBI’s net non-monetary liabilities.

M1:

- =Currency with the public + Deposit money of the public (Demand deposits with the banking system + ‘Other’ deposits with the RBI).

M2:

- =M1 + Savings deposits with Post office savings banks.

M3: (Broad concept of money supply)

- = M1+ Time deposits with the banking system

- = Net bank credit to the Government + Bank credit to the commercial sector + Net foreign exchange assets of the banking sector + Government’s currency liabilities to the public – Net non-monetary liabilities of the banking sector (Other than Time Deposits).

M4:

- =M3 + All deposits with post office savings banks (excluding National Savings Certificates).

Money Multiplier (m)

The money multiplier is an approach used to demonstrate the maximum amount of broad money that could be created by commercial banks for a given fixed amount of base money and reserve ratio.

- The money multiplier, m, is the inverse of the reserve requirement, R:

- For example, with the reserve ratio of 20 percent, this reserve ratio, R, can also be expressed as a fraction:

- So then the money multiplier, m, will be calculated as:

This number is multiplied by the amount of reserves to estimate the maximum potential amount of the money supply. For example, from Rs.100 can be multiplied by 5 to generate Rs.500 money supply if Reserve Ratio is 1/5 (20%) or when Money Multiplier is 5. When Reserve Ratio is 1/4 (25%) or when Money Multiplier is 4, that would generate only Rs. 400 as money supply.

How does demonetisation affect reserve money and money supply?

When a currency note of a particular denomination ceases to be legal tender, the central bank’s liabilities are reduced to that extent and also the amount of currency in circulation declines.

On November 8, 2016 Government of India made Rs. 500 and Rs. 1000 notes invalid. This meant that around Rs. 15 lakh crore worth of high-value legal tender being withdrawn from circulation.

So, the entire liability of Rs. 15 lakh crore due to Rs.500 and Rs.1000 notes in circulation was nullified.

But the demonetisation impact is neutralised when the demonetised currency is replaced with new accepted currency notes. You may note that, even if an individual chooses to park the cash as deposits with banks, it forms a part of the overall money supply.

Thus, say for example, if the banks or RBI got Rs.10 lakh crore as deposits after the demonetisation scheme was introduced until December 31, 2016 that figure forms part of the overall money supply. You may also note that, in this example Rs.5 lakh crore never made entry into the banking records.

Now the net-liability = Rs.15 lakh crore – Rs.5 lakh crore = Rs.10 lakh crore. This liability figure is less that the initial liability of Rs. 15 lakh crore. So RBI and banks gain by the demonetization move, at-least on paper.

Why is currency in circulation a liability to RBI or government?

Let us examine what is the status of the currency we hold in our hands.

Section 26 of the Reserve bank of India Act 1934 (“RBI Act”) states as follows:

(1) Subject to the provisions of sub-section (2), every bank note shall be legal tender at any place in 4

[India] in payment or on account for the amount expressed therein, and shall be guaranteed by the 5

[Central Government].

This means that the money the public hold in hand or in the bank is a debt guaranteed by the

government (to us). Currency thus represents a ‘public debt’ owed by the government to the holders of

the bank notes – the public.

How will demonitisation affect the RBI’s balance sheet?

If people choose not to declare and surrender their high-denomination currency notes, then RBI stands to gain to the extent that its currency liabilities are lowered.

The gains it makes in the process are transferred to its reserves and then appropriated in its profit and loss account. This gives it leeway to transfer higher amounts as dividends to the government.

No comments:

Post a Comment