There are two kinds of banking licences that are granted by the Reserve Bank of India – Universal Small Finance Banks and Payment Banks are examples of differentiated banks in India. Custodian Banks and Wholesale and Long-Term Finance banks (WLTF) are newly proposed differentiated banks. Bank Licence and Differentiated Bank Licence. Differentiated Banks (niche banks) are banks that serve the needs of a certain demographic segment of the population.

There are two kinds of banking licences that are granted by the Reserve Bank of India – Universal Small Finance Banks and Payment Banks are examples of differentiated banks in India. Custodian Banks and Wholesale and Long-Term Finance banks (WLTF) are newly proposed differentiated banks. Bank Licence and Differentiated Bank Licence. Differentiated Banks (niche banks) are banks that serve the needs of a certain demographic segment of the population. Differentiated Banks vs Universal Banks

Differentiated banks are distinct from Universal Banks (Eg: Commercial Banks like SBI, HDFC, ICICI etc) as they are infused as niche segments. Niche banks typically target a specific market and tailor the bank’s operations to this target market’s preferences. The differentiation could be on account of capital requirement, the scope of activities or area of operations. As such, they offer a limited range of services/products or function under a different regulatory dispensation.

Background of Small Finance Banks and Payment Banks

The concept of differentiated banks is not entirely new. In fact, and in a sense, the Urban Co Operative Banks (UCBs), the Primary Agricultural Credit Societies (PACS), the Regional Rural Banks (RRBs) and Local Area Banks (LABs) could be considered as differentiated banks as they operate in localized areas.

But the present concept of differentiated banks can be said as first discussed in 2007. Thereafter, the concept was once again discussed in a Paper “Banking Structure in India – The Way Forward”, brought out by the Reserve Bank in August 2013. RBI granted in-principle approvals to 11 entities for setting up payments banks (PBs) in August 2015 and 10 for Small Finance Bank (SFB) in September 2015.

Small Finance Banks (SFBs)

- They are niche banks that focus and serve the needs of a certain demographic segment of the population.

- The objectives of setting up of small finance banks will be to further financial inclusion by (1) the provision of savings vehicles (2) supply of credit to small business units; small and marginal farmers; micro and small industries; and other unorganised sector entities, through high technology-low cost operations.

- SFBs was recommended by the Nachiket Mor committee on financial inclusion.

Scope of activities of SFBs

- The small finance banks shall primarily undertake basic banking activities of acceptance of deposits and lending to unserved and underserved sections including small business units, small and marginal farmers, micro and small industries and unorganised sector entities.

- There will not be any restriction in the area of operations of small finance banks.

Criteria for setting up SFBs

- Individuals/professions with 10 years of experience in finance, Non-Banking Financial Companies (NBFCs), micro finance companies, local area banks are eligible to set up SFBs.

- The minimum paid-up equity capital for small finance banks shall be Rs. 100 crore.

- The promoter’s minimum initial contribution to the paid-up equity capital of such small finance bank shall at least be 40 per cent and gradually brought down to 26 per cent within 12 years from the date of commencement of business of the bank.

- The foreign shareholding in the small finance bank would be as per the Foreign Direct Investment (FDI) policy for private sector banks as amended from time to time.

- The small finance banks will be required to extend 75 per cent of its Adjusted Net Bank Credit (ANBC) to the sectors eligible for classification as priority sector lending (PSL) by the Reserve Bank.

- SFBs have to maintain Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) as per RBI norms.

- At least 50 per cent of its loan portfolio should constitute loans and advances of up to Rs. 25 lakh.

What can Small Finance Banks do?

- Sell forex to customers.

- Sell mutual funds, insurance and pensions.

- Can convert into a full-fledged bank.

What Small Finance Banks can’t do?

- Extend large loans.

- Cannot float subsidiaries and deal in sophisticated products.

Challenges to Small Finance Banks

- Have to compete with existing public sector banks and RRBs.

- Micro Finance Institution (MFI)/NBFC are specialised in micro lending operations with limited exposure to banking operations; that means they have to hire, train talent from the banking industry.

- The cost of deposit mobilisation will be higher for these banks as they cover rural and underserved segment.

Payment Banks

- The objectives of setting up of payments banks will be to further financial inclusion by providing (1) small savings accounts (2) payments/remittance services to migrant labour workforce, low-income households, small businesses, other unorganised sector entities and other users.

- They will not lend to customers and will have to deploy their funds in government papers and bank deposits.

Scope of activities

- Acceptance of demand deposits-Payments bank will initially be restricted to holding a maximum balance of Rs. 100,000 per individual customer.

- Issuance of ATM/debit cards-Payments banks, however, cannot issue credit cards.

- Payments and remittance services through various channels.

- Business Correspondents (BC) of another bank, subject to the Reserve Bank guidelines on BCs.

- Distribution of non-risk sharing simple financial products like mutual fund units and insurance products, etc.

- The payments bank cannot undertake lending activities.

Criteria for setting up Payment banks

- Existing non-bank Pre-paid Payment Instrument (PPI) issuers; and other entities such as individuals / professionals; Non-Banking Finance Companies (NBFCs), corporate Business Correspondents (BCs), mobile telephone companies, supermarket chains, companies, real sector cooperatives; that are owned and controlled by residents; and public sector entities may apply to set up payments banks.

- Promoter/promoter groups should be ‘fit and proper’ with a sound track record of professional experience or run their businesses for at least a period of five years in order to be eligible to promote payments banks.

- The minimum paid-up equity capital for small finance banks shall be Rs. 100 crore.

- Maintains minimum 75% of deposits in Government bond and maximum 25% deposits with other scheduled commercial banks.

- The promoter’s minimum initial contribution to the paid-up equity capital of such payments bank shall at least be 40 per cent for the first five years from the commencement of its business.

- The bank should have a high powered Customer Grievances Cell to handle customer complaints.

- The operations of the bank should be fully networked and technology driven from the beginning, conforming to generally accepted standards and norms.

What can Payment Banks do?

- Offer internet banking, sell mutual funds, insurance and pensions.

- Have business correspondents and ATMs.

- Offer bill payment service for customers

- They can enable transfers and remittances from a mobile phone.

- They can offer forex services at charges lower than bank

- They can provide forex cards to travellers, usable as debit or ATM card all over India.

- They can also offer card acceptance mechanism to third parties such as “Apple Pay”.

What Payment Banks can’t do?

- Offer credit cards

- Extend loans

- Handle cross-border remittances

- Accept NRI deposits

Challenges for payment banks

- Low revenue-can’t undertake any lending businesses and the income stream is initially restricted to charges on remittances and efficiency of operations.

- Required to invest minimum 75 per cent of its “demand deposit balances” into government securities. This limits their ability to earn from the deposit base as well.

- Banks are already offering most services that payments banks can and hence, for payments banks to offer a new and differentiated proposition will not be easy.

- Other saving instruments like Kisan Vikas Patra, gold bonds etc have better returns than payment banks.

- Experience from Jan Dhan Yojna has shown that many such no-frill accounts have remained dormant, thus affecting the viability of the banks.

Payment Banks vs Small Finance Banks: Differences

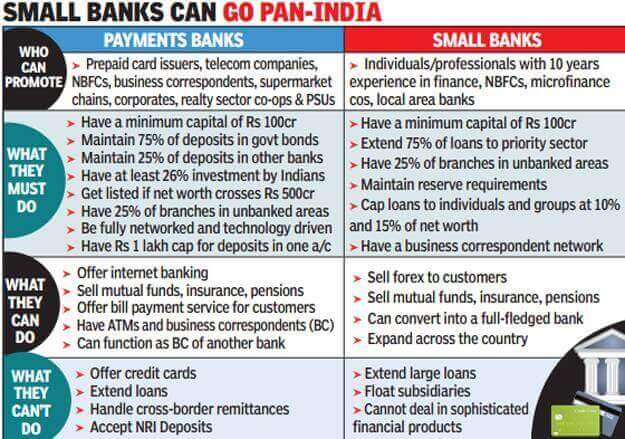

Image courtesy: Times of India

Newly Proposed Differentiated Banks

In addition to recently licensed differentiated banks such as payments banks and small finance banks, the Reserve Bank has been exploring the possibilities of licensing other differentiated banks such as custodian banks and banks concentrating on wholesale and long-term financing.

Custodian banks: Custodian Banks are specialised financial institutions mainly responsible for safeguarding a firm’s or individual’s financial assets and are typically not engaged in conventional retail lending.

Wholesale banks: Wholesale banks are lenders that cater to large corporates which require long-term finance, particularly those engaged in infrastructure development. Typically, these banks raise long-term funds which are exempted from maintaining regulatory requirements like cash reserve ratio and statutory liquidity ratio.

Summary and Way forward

Image Courtesy: Business Standard

- Both Payments Banks and Small Finance Banks are ‘niche’ or ‘differentiated’ banks with the common objective of furthering financial inclusion.

- India’s domestic remittance market is estimated to be about Rs 800-900 billion and growing. With money transfer made possible through mobile phones, a big chunk of it, especially that of the migrant labour could shift to this new platform.

- Payment bank can also play a significant role in implementing the government Direct Benefit Transfer scheme, where subsidies on health care, education and gas are paid directly to beneficiaries’ account.

- Payment banks have proved hugely popular in other developing countries. In Kenya, the most cited success story, Vodafone M-Pesa is used by two in three of adults to store money, make purchases and transfer funds to friends, relatives etc.

Article by: Arun Kumar. Arun completed his B.Tech from Indian Institute of Technology (BHU), Varanasi. His interests include Economics and Current Affairs.

No comments:

Post a Comment